Market Week: June 17, 2024

Presented by William Prentice, AWMA®, CFP®, CIMA®

KEY DATES/DATA RELEASES

6/18: Retail sales, industrial production

6/20: Housing starts

6/21: Existing home sales

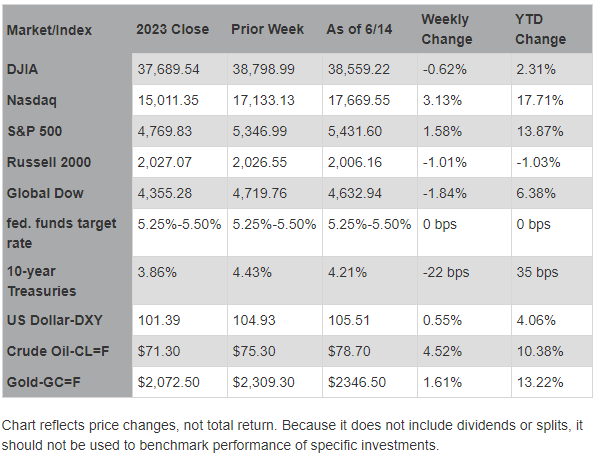

THE MARKETS (as of market close June 14, 2024)

U.S. stocks outpaced the rest of the world last week as global investors sought relief from the turmoil caused by European elections. Tech stocks carried the market as investors digested a pair of cooling inflation reports. The Nasdaq closed at record highs every day last week, and the S&P 500 also posted a solid gain, while the Russell 2000, the Dow, and the Global Dow all lost ground. The benchmark 10-year Treasury yield saw its largest weekly decline of the year. Crude oil prices surged, gold prices rose, and the dollar advanced for the fourth week in a row.

Stocks edged higher to begin last week. Big tech firms, particularly AI companies, helped support the market uptick. Bond yields rose, with 10-year Treasuries closing at 4.46% after gaining nearly 4.0 basis points. The Nasdaq led the benchmark indexes listed here after gaining 0.4%. The S&P 500 and the Russell 2000 added 0.3%. The Dow rose 0.2%, while the Global Dow dipped 0.2%. Crude oil prices closed at about $77.95 per barrel, up $2.42. The dollar and gold prices advanced. Utilities and energy led the market sectors, while financials and materials underperformed.

On Tuesday, the Nasdaq (0.9%) and the S&P 500 (0.3%) notched fresh records following the announcement by a major tech company of its AI platform. The remaining benchmark indexes closed in the red, led by the Global Dow (-0.8%), followed by the Russell 2000 (-0.4%) and the Dow (-0.3%). Bond prices jumped higher, pulling yields down, with 10-year Treasury yields falling 6.5 basis points to 4.40%. Crude oil prices moved up marginally to $77.86 per barrel. The dollar edged up 0.1% against a basket of currencies, while gold prices gained 0.2%.

Stocks surged again on Wednesday when the latest inflation data came in cooler than expected, and ended the day higher even though the Fed later dialed back its interest rate forecasts for the remainder of 2024 (see below). Most of the benchmark indexes listed here posted gains led by the Russell 2000 and the Nasdaq, which climbed 1.8% and 1.5%, respectively. The S&P 500 added about 0.9%, followed by the Global Dow (0.4%). The Dow edged down 0.1%. Ten-year Treasury yields fell 11 basis points, landing slightly below 4.3%, in response to the news on inflation and interest rates. Crude oil prices rose again, closing at $78.47 per barrel. The dollar fell 0.5%, while gold prices rose 0.6%.

Stock market performance was mixed last Thursday, after a gauge of wholesale prices unexpectedly reported the largest decline in seven months. Only the Nasdaq (0.3%) and the S&P 500 (0.2%) held on to small gains, while the small caps of the Russell 2000 (-0.9%), the Global Dow (-0.7%), and the Dow (-0.2%) all lost value. Information technology and real estate gained the most among the market sectors, while communication services and energy fell the furthest. Ten-year Treasury yields ticked down to 4.24%. Gold fell 1.5% and crude oil prices declined 0.5%, while the dollar advanced 0.5%.

On Friday, global equity markets reacted to growing anxiety over a political crisis in France, and a closely-watched gauge of U.S. consumer sentiment dove to a seven-month low. Four of the benchmark indexes closed the session lower, led by the Russell 2000, which fell 1.6%. The Global Dow declined 0.6%, while the S&P 500 and the Dow dipped 0.4% and 0.2%, respectively. The Nasdaq edged up 0.1%. Gold prices jumped 1.2% and the dollar rose, while 10-year Treasury yields dipped to 4.21%. Crude oil prices ticked up slightly.

Several areas of the economy are highlighted this week, starting with the May retail sales report. Inflationary pressures at the retail level were somewhat muted in April. The Federal Reserve report on industrial production for May is also coming out. Industrial production was unchanged in April, although manufacturing output slowed. Lastly, the Census Bureau report on housing starts for May and data on existing home sales will be released. The number of issued building permits declined in April, while housing starts advanced. Sales of existing homes declined in April, although the median price for existing homes rose to over $400,000.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates).

News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 largest, publicly traded companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. The U.S. Dollar Index is a geometrically weighted index of the value of the U.S. dollar relative to six foreign currencies. Market indexes listed are unmanaged and are not available for direct investment.

Prepared by Broadridge Advisor Solutions. © 2024 Broadridge Financial Services, Inc.