Welcome

Our Vision

Our business has placed clients' best interest at the forefront of every decision since inception, embracing the fiduciary standard nearly a decade prior to the industry as a whole. By retaining a select group of advisers in counsel to a limited number of clients, we are deeply engaged and deliver a world class wealth management experience. We continue to develop our team by adding talent and capabilities to enhance client services.

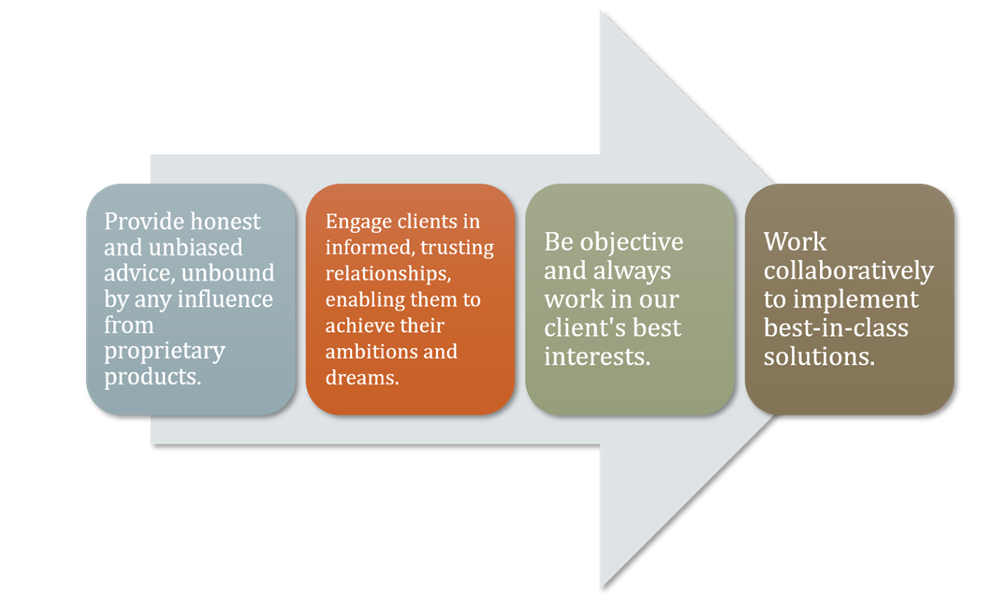

Our Values

The foundation of support for the Prentice Wealth Management vision rests in our conviction to a set of core values that are considered inviolate. These simple, yet powerful beliefs set the "rules of conduct" that shape the culture of our firm.

Our Clients

Our firm is privileged to have numerous relationships dating back over two decades. Through our comprehensive wealth management process, we deliver quality, unbiased advice based on time-tested principles to a broad array of clients. We serve clients throughout the United States and internationally that value a partner dedicated to their financial security. Our client base includes:

Our Planning Process

We are a team of professionals dedicated to goal attainment through strict adherence to the financial planning process. We have over 120 years of combined experience in the financial services industry with subject matter proficiency in nearly every discipline. Through our internal resources and external relationships, we collaboratively advise clients on a vast number of issues to advance their ambitions and empower them to live life more confidently.

- External Relationships

Personal Services

Business Services

A Lifetime of Services

At Prentice Wealth Management, we deliver optimal solutions for every stage of life, from parents seeking to protect and grow assets while saving for college, to empty nesters preparing for their new paradigm and retirees concerned about managing and distributing their wealth.

Accumulation

Building and Protecting Your Wealth

Distribution

Strategic Withdrawal Planning

Gifting & Transfer

Leaving a Legacy

Care Deeply

Lead Confidently

Surpass Expectations

Enhance Lives