Market Week: August 7, 2023

Presented by William Prentice, AWMA®, CFP®, CIMA®

KEY DATES/DATA RELEASES

8/8: International trade in goods and services

8/10: Consumer Price Index, Treasury report

8/11: Producer Price Index

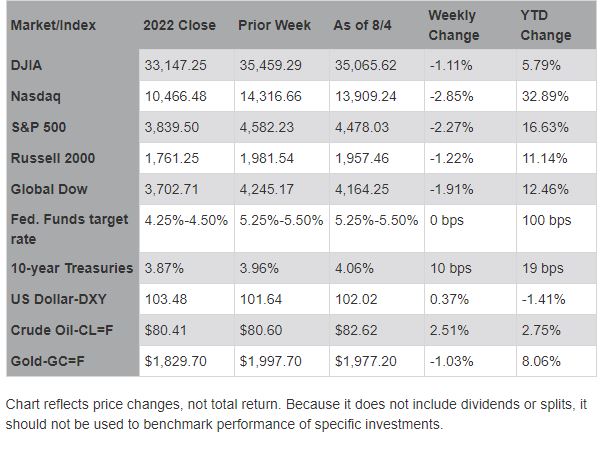

THE MARKETS (as of market close August 4, 2023)

Stocks endured a losing week for the first time since early July. Each of the benchmark indexes listed here lost value, with the S&P 500 and the Nasdaq suffering the steepest weekly declines since March. Investors dealt with the downgrade of the U.S. government's credit rating and evidence that job growth may be slowing (see below). Corporate earnings have generally matched or beaten expectations, but a couple of bellwether tech and communications companies proffered disappointing earnings. Bond prices fell, pushing yields higher. The dollar rose higher, while gold prices slid lower. Crude oil prices increased for the sixth straight week, the longest streak in more than a year.

Wall Street closed out the month of July on an uptick, with each of the benchmark indexes listed here posting gains by the close of trading last Monday. The Russell 2000 advanced 1.1% to lead the indexes, followed by the Global Dow and the Dow (0.3%). The Nasdaq and the S&P 500 rose 0.2%. Ten-year Treasury yields closed the day where they began at 3.95%. Crude oil prices dipped marginally to settle at $81.65 per barrel. The dollar was flat, while gold prices fell 0.4%.

Stocks closed generally lower last Tuesday, with only the Dow (0.2%) advancing among the benchmark indexes listed here. The Global Dow fell 0.7%, followed by the Russell 2000 (-0.5%), the Nasdaq (-0.4%), and the S&P 500 (-0.3%). Most of the market sectors lost value, with only industrials and information technology gaining ground. Crude oil prices declined for the second straight session, falling 0.1% to $81.73 per barrel. The yield on 10-year Treasuries rose 9.2 basis points to 4.05%. The dollar gained traction, climbing 0.4%, while gold prices slid 1.4%.

The stock market took a tumble last Wednesday, with the Nasdaq experiencing its worst day in nearly five months. Investors may have been rattled after the credit rating firm Fitch downgraded the U.S. government's credit rating, which prompted an angry response from the White House and the Treasury Department. Fitch based its rating decision, in part, on the federal government's growing levels of debt and political instability, including the January 6, 2021 attack on the Capitol. The Nasdaq slid 2.2%, followed by the Global Dow (-1.6%), the Russell 2000 and the S&P 500 (-1.4%), and the Dow (-1.0%). Yields on 10-year Treasuries rose 2.7 basis points to 4.07%. Crude oil prices continued to decline, dropping nearly 2.0% to $79.79 per barrel. The dollar rose 0.3%, while gold prices fell 0.4%.

Stocks declined for a third straight session last Thursday as investors continued to react to Fitch's downgrade of U.S. bonds. Ten-year Treasury yields spiked 11.1 basis points to 4.18%, the highest yield in nine months, while the dollar slipped lower, impacted by the credit downgrade. The Global Dow fell the furthest, down 0.4%, followed by the Russell 2000 and the S&P 500, which dipped 0.3%. The Dow lost 0.2%, while the Nasdaq essentially broke even, down 0.1%. Crude oil prices reversed course, gaining 2.8% to $81.71 per barrel. Gold prices declined 0.3%.

Wall Street closed lower last Friday to end a disappointing week for stocks. Only the Global Dow (0.4%) advanced among the benchmark indexes listed here. The S&P 500 slid 0.5%, followed by the Dow and the Nasdaq, which fell 0.4%. The small caps of the Russell 2000 dipped 0.2%. Ten-year Treasury yields, which had climbed for most of the week, fell nearly 13.0 basis points on the day. Crude oil prices rose 1.3%. The dollar declined 0.5%. Gold prices ended the day up 0.4%.

Inflation data for July is available this week. The most recent Consumer Price Index showed prices rose 0.2% in June, while the 12-month increase was 3.0%. The Producer Price Index revealed prices inched up 0.1% in June and 0.1% over the last 12 months. Inflationary pressures are clearly waning, while the economy has shown resilience.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 largest, publicly traded companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. The U.S. Dollar Index is a geometrically weighted index of the value of the U.S. dollar relative to six foreign currencies. Market indexes listed are unmanaged and are not available for direct investment.

Prepared by Broadridge Advisor Solutions. © 2023 Broadridge Financial Services, Inc.