Market Week: September 11, 2023

Presented by William Prentice, AWMA®, CFP®, CIMA®

KEY DATES/DATA RELEASES

9/13: CPI, Monthly Treasury Statement

9/14: PPI, retail sales

9/15: Import and export prices, industrial production

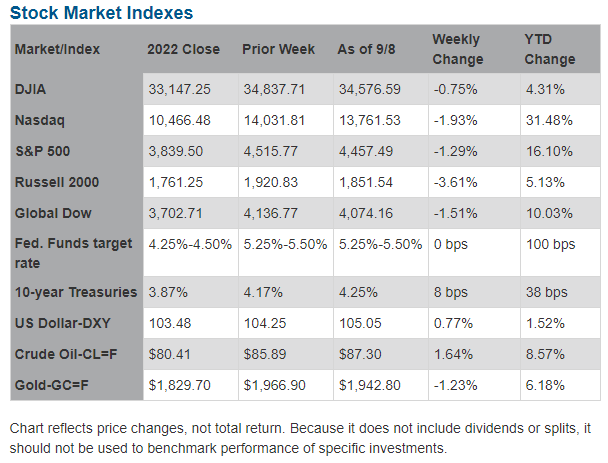

THE MARKETS (as of market close September 8, 2023)

Wall Street saw stocks slide lower last week, with each of the benchmark indexes closing in the red. Trading was choppy throughout the holiday-shortened week as traders anticipated this week's inflation data. The Russell 2000 fell the furthest, followed by the Nasdaq, the S&P 500, the Global Dow, and the Dow. Crude oil prices advanced for the second straight week and are on track for a second consecutive monthly gain as some OPEC+ countries including Russia extended supply cuts. As investors await this week's Consumer Price Index, rising oil prices could push overall prices higher than expected. Last week, 10-year Treasury yields rose as did the dollar, while gold prices declined.

Stocks opened last Tuesday in the red, with each of the benchmark indexes losing value. The Russell 2000 fell 2.1%, followed by the Global Dow (-0.8%), the Dow (-0.6%), the S&P 500 (-0.4%), and the Nasdaq (-0.1%). Crude oil prices reached $86.71 per barrel, a 2023 high, after Saudi Arabia and Russia said they would extend production cuts for the remainder of the year. Ten-year Treasury yields climbed 9.5 basis points to reach 4.26%. The dollar jumped 0.7%, while gold prices slid 0.8%. Ten-year Treasury yields ticked up 2.2 basis points to 4.29%. The dollar was flat. Gold prices slid 0.5%.

Wall Street saw stocks slide again last Wednesday on fears of rising inflation. Crude oil prices continued to rise, climbing to $87.55 per barrel. Interest rate-sensitive tech shares lagged, with information technology falling 1.4%. The Nasdaq fell the furthest among the benchmark indexes listed here after losing 1.1%. The S&P 500 dropped 0.7%, followed by the Dow (-0.6%), the Global Dow (-0.4%), and the Russell 2000 (-0.3%).

Last Thursday, the Nasdaq posted its fourth straight session loss, while the S&P 500 fell for the third consecutive day. Tech shares pulled the benchmark indexes lower as China reported its intent to broaden its ban on Apple iPhones. The Dow inched up 0.2% on the day, the only index of those listed here to post a gain. The Russell 2000 (-1.0%) and the Global Dow (-0.4%) declined, along with the Nasdaq (-0.9%) and the S&P 500 (-0.3%). The yield on 10-year Treasuries slipped 3.0 basis points to 4.26%. Crude oil prices reversed an upward trend, falling 0.8% to settle at $86.86 per barrel. Both the dollar and gold prices declined.

Stocks closed mostly higher last Friday. The Dow added 0.2%, while the Nasdaq and the S&P 500 each inched up 0.1%. The Global Dow and the Russell 2000 dipped 0.2% and 0.1%, respectively. Ten-year Treasury yields were flat. Thursday's decline in crude oil prices proved short-lived as prices per barrel rose 0.5% on Friday. The dollar and gold prices were unchanged.

The latest reports on the Consumer Price Index and the Producer Price Index are out this week. Consumer prices edged up 0.2% in July and 3.2% for the 12 months ended in July. Producer prices rose 0.3% in July and 0.8% for the year.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 largest, publicly traded companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. The U.S. Dollar Index is a geometrically weighted index of the value of the U.S. dollar relative to six foreign currencies. Market indexes listed are unmanaged and are not available for direct investment.

Prepared by Broadridge Advisor Solutions. © 2023 Broadridge Financial Services, Inc.