Market Week: May 8, 2023

Presented by William Prentice, AWMA®, CFP®, CIMA®

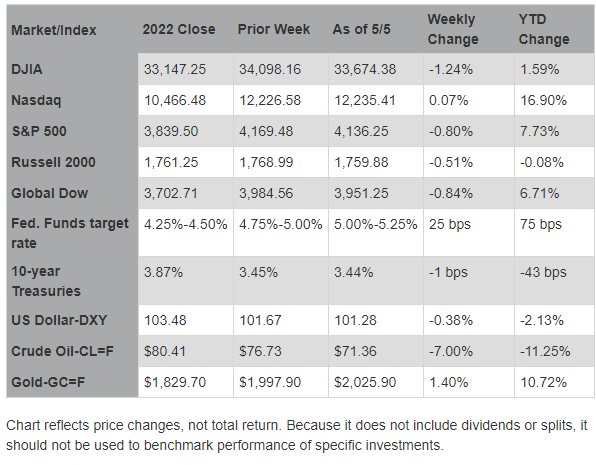

THE MARKETS (as of market close May 5, 2023)

Stocks closed last week generally lower, with only the Nasdaq eking out a minimal gain. A rally last Friday wasn't enough to recoup losses experienced during the week. Investors had quite a bit to digest over the past week. The Federal Reserve hiked the federal funds rate 25 basis points and gave no clear indication as to whether and when more rate increases may be coming. Regional banks continued to struggle, however bank stocks rallied late in the week to help ease investor concerns. The April jobs report was solid, but also showed the pace of hiring was slowing. Crude oil prices continued to tumble on concerns of a slowing U.S. economy and tepid Chinese demand. Gold prices rebounded from the prior week, once again moving above the $2,000.00 per ounce mark.

Wall Street opened last week with a whimper, with stocks unable to maintain early momentum, ultimately closing lower. Monday saw each of the benchmark indexes listed here end the session marginally lower, with the exception of the Russell 2000, which ended the day flat. Ten-year Treasury yields added 12.2 basis points to close at 3.57%. Crude oil prices fell 1.3% to $75.75 per barrel. The dollar advanced 0.5%, while gold prices fell 0.4%.

Markets fell last Tuesday, pulled lower by declining financial and energy stocks. Investor concerns ticked higher following news that other regional banks were in jeopardy of failing, which came ahead of Wednesday's anticipated 25-basis point interest rate hike by the Federal Reserve. The Russell 2000 was hit the hardest, dropping 2.1%, followed by the Global Dow and the S&P 500, which slipped 1.2%. The Dow and the Nasdaq lost 1.1%. Ten-year Treasury yields fell 13.5 basis points to 3.43% as bond prices surged on growing demand. Crude oil prices settled at about $71.64 per barrel, down 5.3% on recession concerns. The dollar slid lower, while gold prices gained 1.7%.

Last Wednesday saw investors respond to the latest interest rate hike from the Federal Reserve by selling stocks. Of the benchmark indexes listed here, only the small caps of the Russell 2000 ended the day in the black, gaining 0.4%. The remaining indexes posted losses, led by the Dow (-0.8%), followed by the S&P 500 (-0.7%), the Nasdaq (-0.5%), and the Global Dow (-0.1%). Crude oil prices dropped nearly 5.0% to $68.26 per barrel, hitting the lowest level since late March amid concerns of a U.S. recession and waning demand in China. The dollar declined for the second straight day. Gold prices advanced nearly 1.0%.

Thursday proved to be another rough day for Wall Street. Investors contemplated more troubling news on the financial front as more regional banks faced possible closures. The Russell 2000 lost 1.2%, followed by the Dow (-0.9%), the Global Dow (-0.8%), the S&P 500 (-0.7%), and the Nasdaq (-0.5%). Bond prices continued to advance, pulling yields lower, with the yield on 10-year Treasuries falling 5.2 basis points to 3.35%. Crude oil prices slipped lower, closing at roughly $68.55 per barrel. The dollar and gold prices climbed higher.

Stocks closed higher last Friday on the heels of a strong jobs report (see below). The Russell 2000 (2.4%) and the Nasdaq (2.3%) led the way, followed by the S&P 500 (1.9%), the Dow (1.7%), and the Global Dow (1.3%). Ten-year Treasury yields added 9.5 basis points to 3.44%. Crude oil prices rose 4.0%. Both the dollar and gold prices ended the session in the red.

EYE ON THE WEEK AHEAD

Inflation data for April is available this week with the releases of the Consumer Price Index and the Producer Price Index. March saw the CPI inch up 0.1%, while the PPI declined 0.5%.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 largest, publicly traded companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. The U.S. Dollar Index is a geometrically weighted index of the value of the U.S. dollar relative to six foreign currencies. Market indexes listed are unmanaged and are not available for direct investment.

Prepared by Broadridge Advisor Solutions. © 2023 Broadridge Financial Services, Inc.