The 2025 Tax filing deadline is April 15, 2026.

PWM Tax Preparation Services

Prentice Wealth Management remains committed to supporting our clients across a wide range of financial needs. As we prepare for the 2025 tax season, we are implementing updated processes designed to maintain our high standards of service while improving efficiency and accuracy.

To ensure a smooth and timely tax preparation experience, please review the following requirements for all new and existing tax clients:

Deadlines

- All tax documents must be received in good order by April 1, 2026.

- Clients who receive K‑1s after this date are exempt from the deadline for those specific documents.

Pricing

- Basic Return (1040 with investments): starting at $325

- Complex Return (1040 with Schedule C or E): starting at $450

- Trusts and Estates: starting at $750

- Businesses: starting at $1,000

- Students (no additional schedules): starting at $100

If you would like a personalized quote, please contact our office.

Submitting Your Documents

- Notify us once you have gathered all required documents. We will then provide you a secure upload link for submission. If you are unable to upload, we'll arrange an alternative that's easy and secure.

- Unopened mail and loose receipts cannot be accepted.

- Receipts and business accounting records must be organized in a spreadsheet or similar format. Templates are available below.

- PWM tax preparation is designed to offer an efficient and economical way to meet your filing requirements. If you would like an end-of preparation review, it can be added upon request and is billed at $100 per 30 minute session.

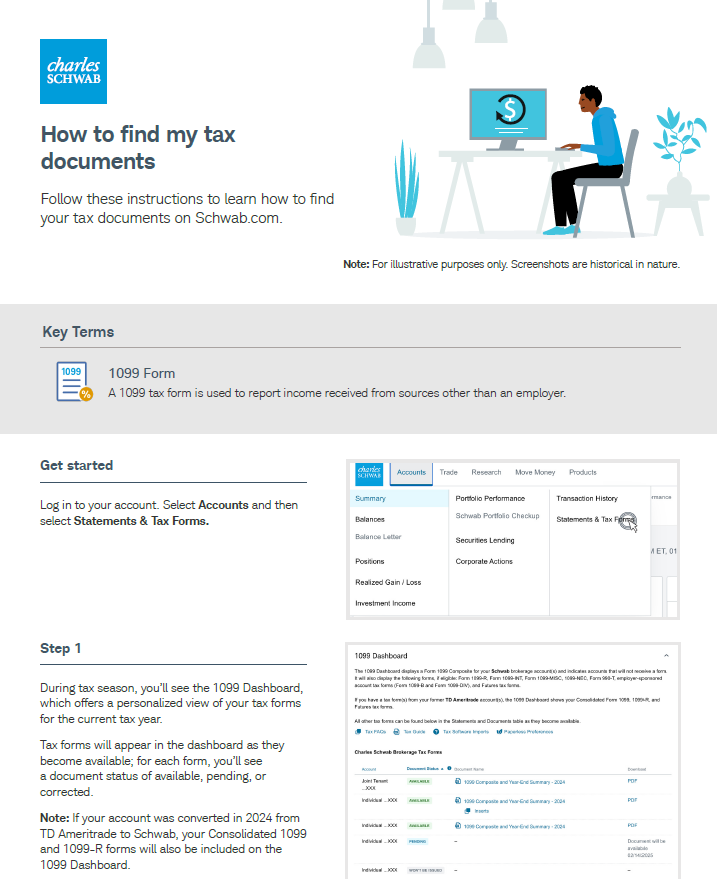

How to Find Tax Documents at Schwab

Click image to view entire document.

Critical Items for Tax Consultations

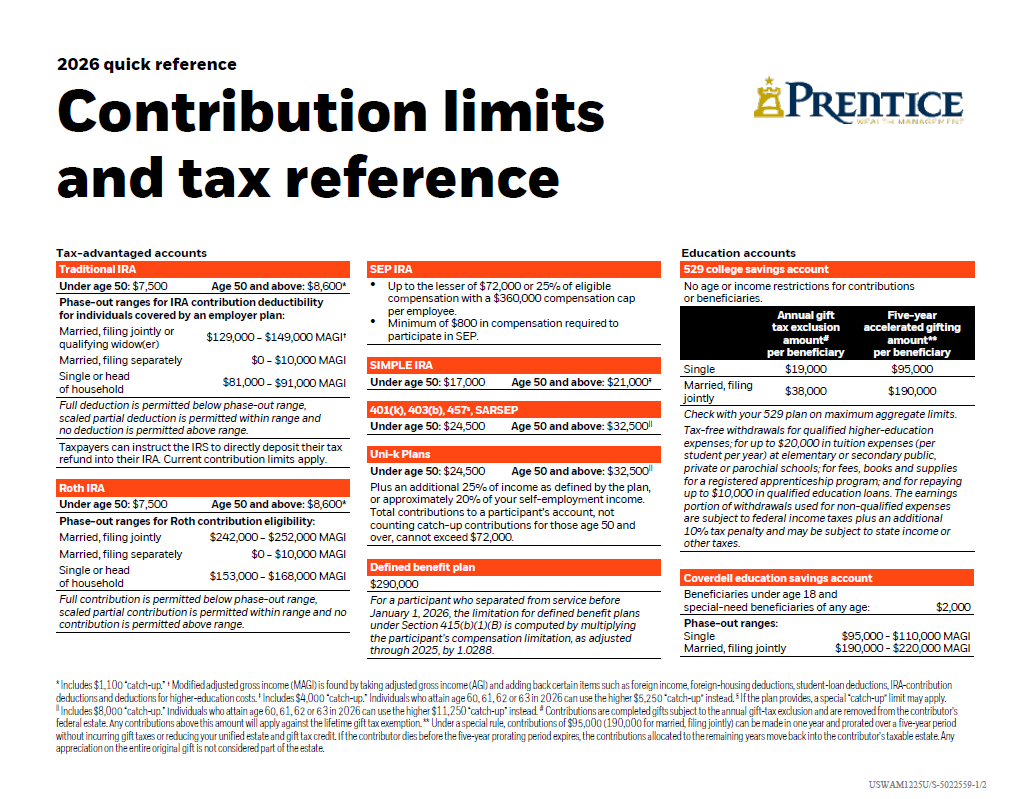

Tax Form Mailing Dates

Investment related tax documents such as consolidated 1099's will generally not be mailed until late February. If you hold securities (usually mutual funds) that report undistributed capital gains, these gains will be reported on a form 2439 which will not be mailed to clients until mid March.

To view the schedule: click here>

Form | Mutual Funds | Pershing | Charles Schwab |

|---|---|---|---|

1099-R | January 31 | January 31 | January 31 |

1099 | February 1-March 15 | February 15-March 15 | February 15 |

Revised 1099 (if applicable) | Mid/Late March | Mid/Late March | Mid/Late March |

5498 | May 31 | May 31 | May 31 |

Click to print/view/download.

Important Links

Neither LPL Financial nor its registered representatives or employees, provide tax or legal services.

You are under no obligation to use the services of PWM Tax Associates, and may choose any qualified professional to provide any of the services described above. PWM Tax Associates and their services are not affiliated with nor endorsed by LPL Financial and Prentice Wealth Management.